ACCOUNT RECOVERY

The Account Recovery project focused on reducing duplicate account creation by enabling existing customers to easily access and manage their active pawns and layaways within a single account.

Customers struggled to locate their existing pawn and layaway loans, often because ticket numbers were misplaced and there was no clear way to recover their accounts. This created frustration and uncertainty, leaving users unsure whether their loans still existed or were accessible. In response, many customers attempted to solve the problem by creating new accounts, which unintentionally fragmented their profiles, disrupted their ability to manage loans, and contributed to dropped pawns and lost value for both the customer and the business.

PROBLEM

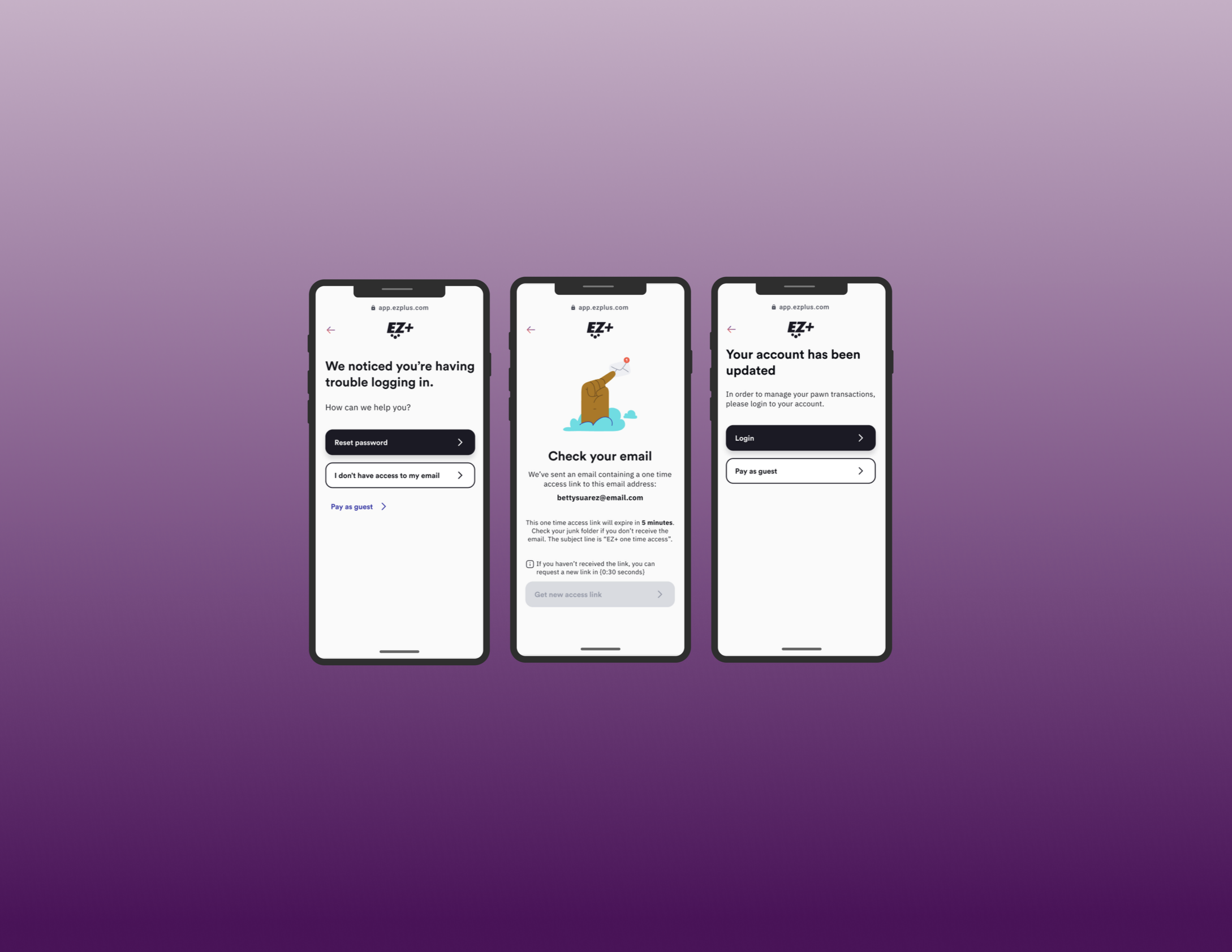

To reduce account fragmentation and improve access to existing pawn and layaway loans, I designed a guided Account Recovery experience that adapts to different customer scenarios, including pawn ticket holders, layaway customers, and retail-only users. Instead of forcing users through a single login or sign-up path, the solution dynamically routes them based on the information they still have, helping customers quickly reconnect to their existing accounts with minimal friction.

The experience uses progressive identity verification and system checks to prevent duplicate account creation, redirecting users into recovery when an existing profile is detected. Clear feedback and confirmation states reassure customers throughout the process, reducing uncertainty around loan status while improving data integrity, decreasing dropped loans, and protecting revenue for both the customer and the business.

SOLUTION

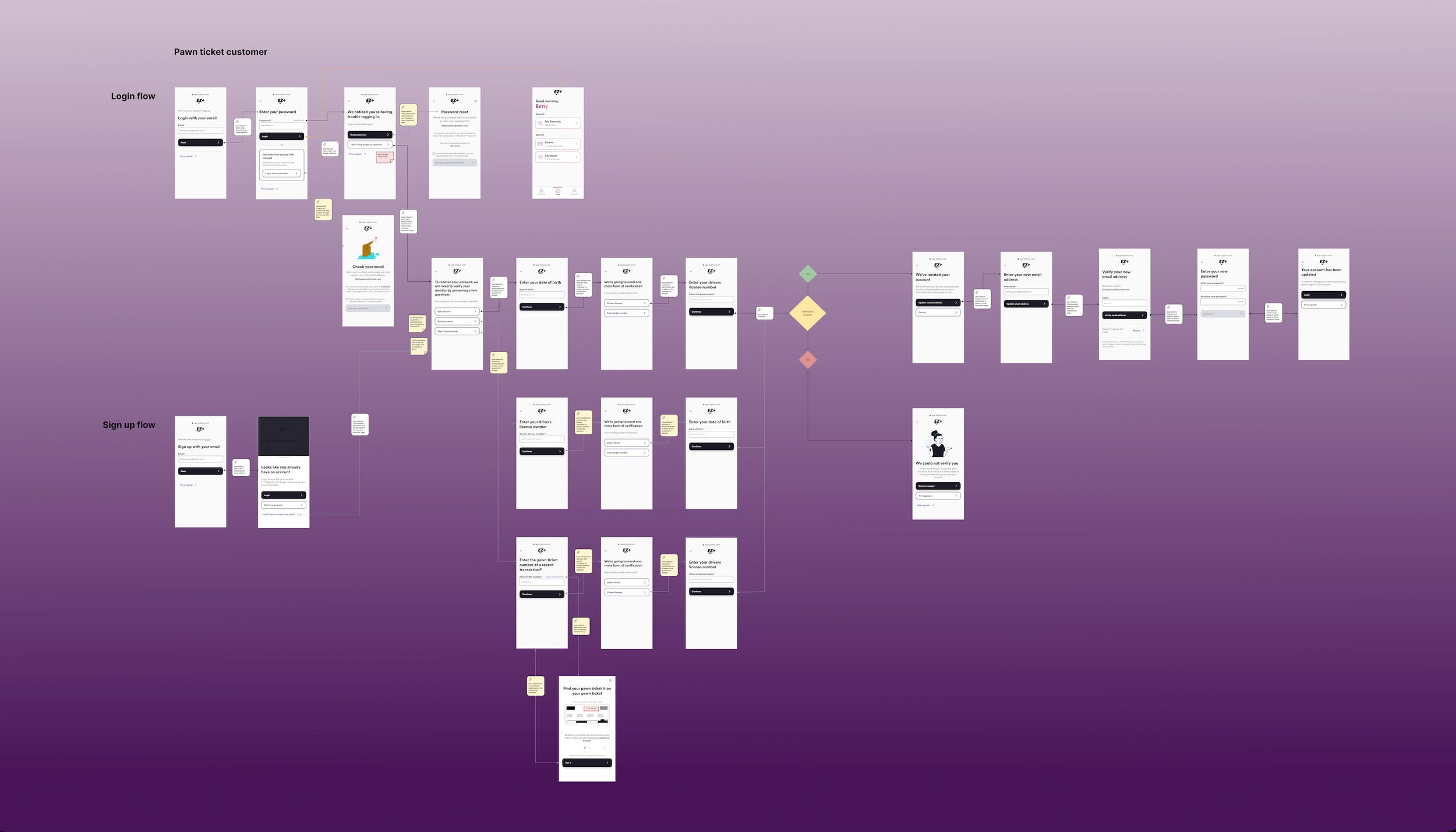

PAWN TICKET CUSTOMERS WORKFLOW

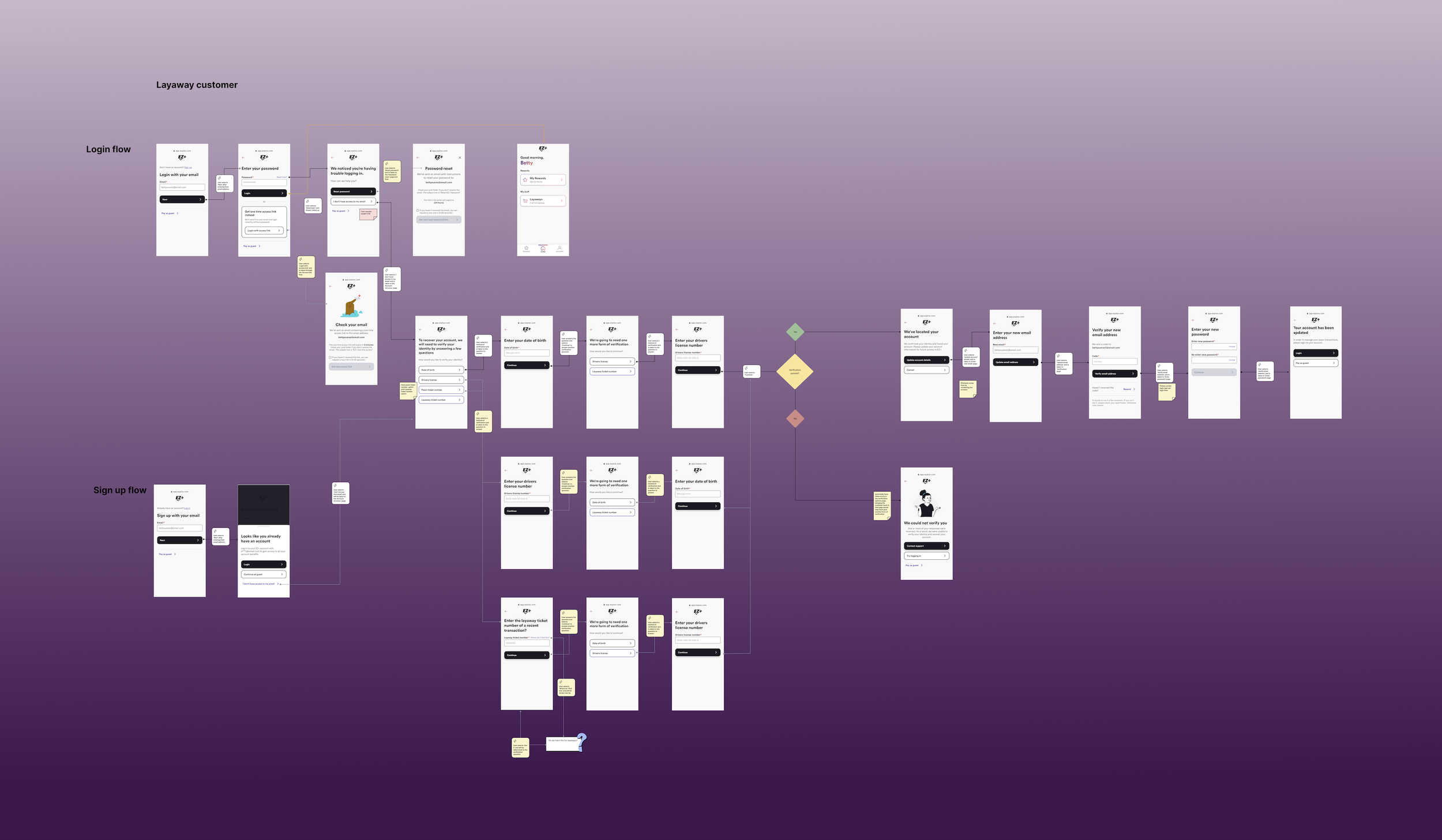

LAYAWAY TICKET CUSTOMERS WORKFLOW

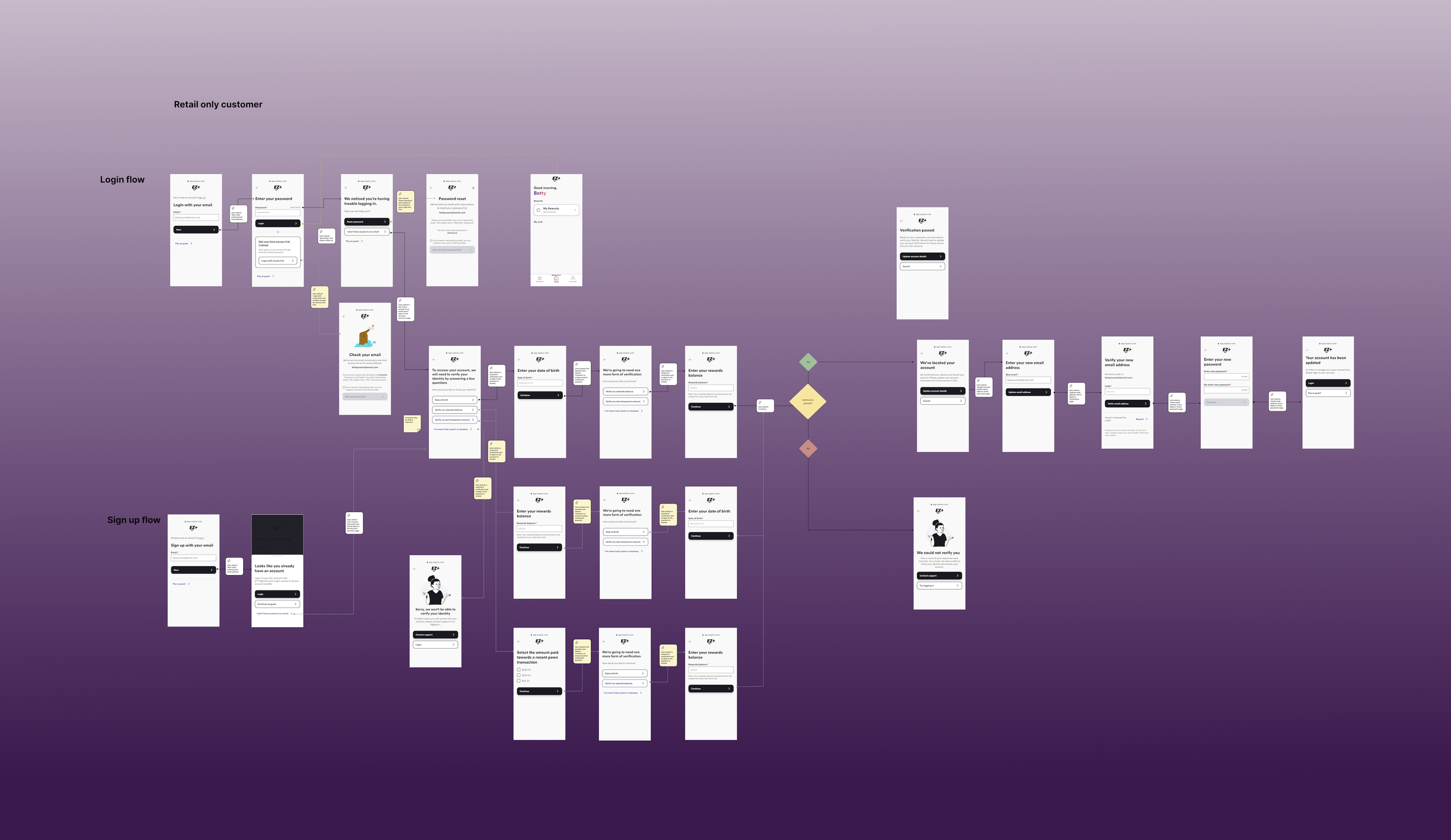

RETAIL ONLY CUSTOMERS WORKFLOW

The Account Recovery project addressed a critical breakdown in how customers accessed their existing pawn and layaway loans. When users misplaced ticket information or were unable to log in, the lack of a clear recovery path created frustration and uncertainty around the status of their loans. In an attempt to regain access, many customers created duplicate accounts, leading to fragmented profiles, inaccurate data, inactive accounts, and unnecessary loan drop-offs that negatively impacted both customer trust and business revenue.

I designed a guided, multi-path account recovery experience that adapts to different customer scenarios, including pawn ticket holders, layaway customers, and retail-only users. By introducing progressive identity verification, duplicate account prevention, and clear system feedback, the solution reduced friction during high-stress moments, improved access to existing loans, strengthened data integrity, and helped retain revenue—while providing customers with confidence that their pawns and layaways were secure and accessible.

SUMMARY